You may use any of these TI calculators:

You may use any of these TI calculators: TI-83 Plus

TI-84 Plus series

TI-Nspire CX series

TI-89 Titanium

TI-73 Explorer

There are at least two approaches to using the TI-calculators for finance problems.

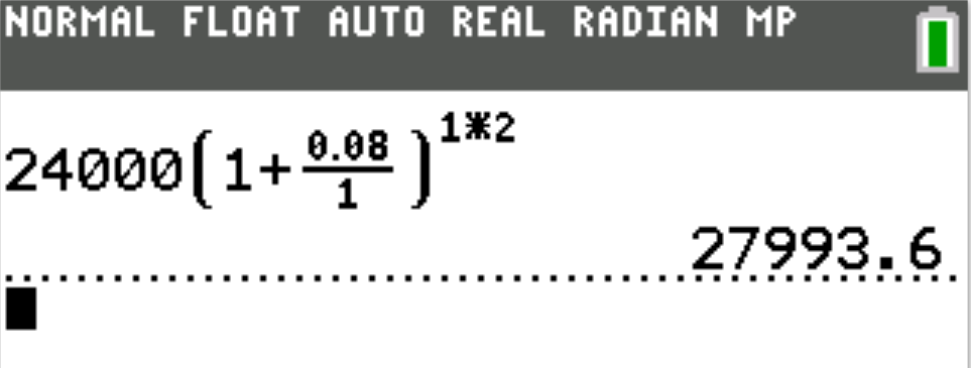

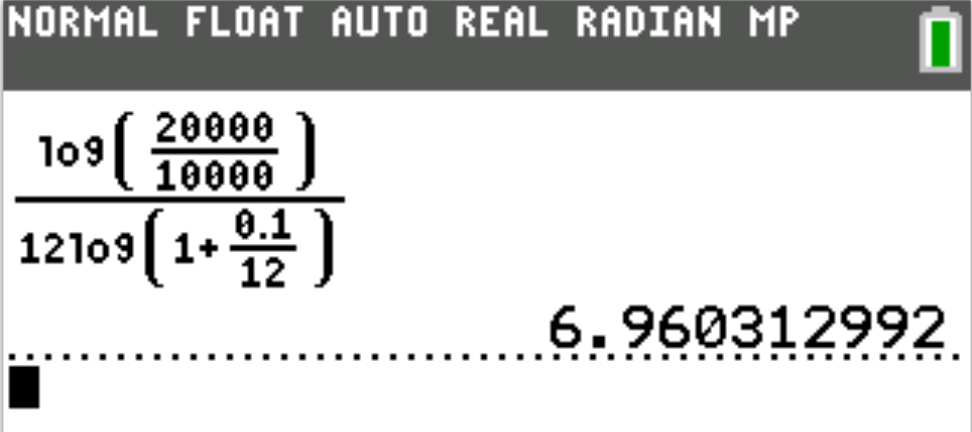

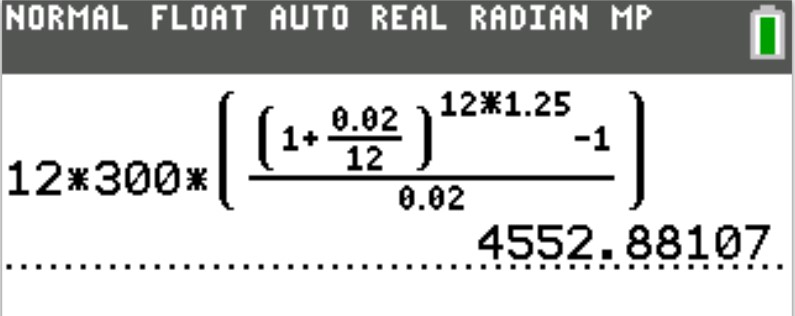

1st Approach: Direct Input of Substituted Values

(1.) Find the applicable Formula

(2.) Substitute the values directly in the formula.

(3.) Enter it directly in the calculator.

(Please see Show/Hide Answer for examples.)

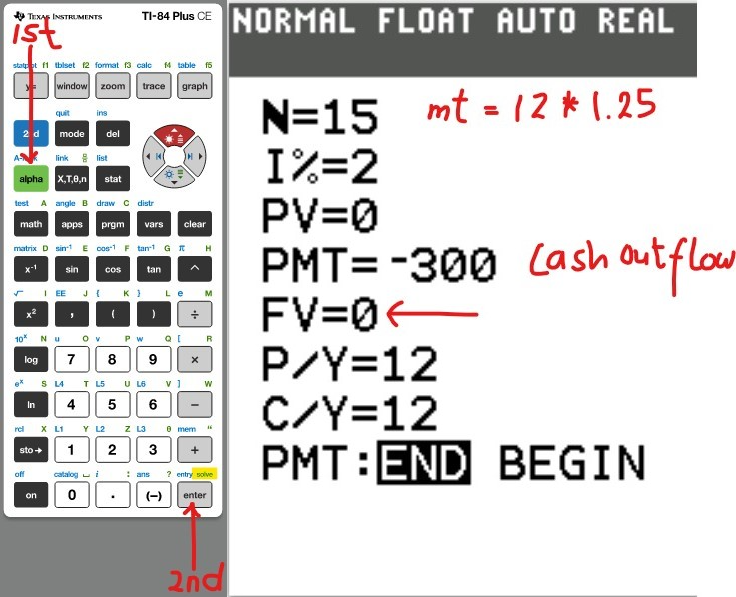

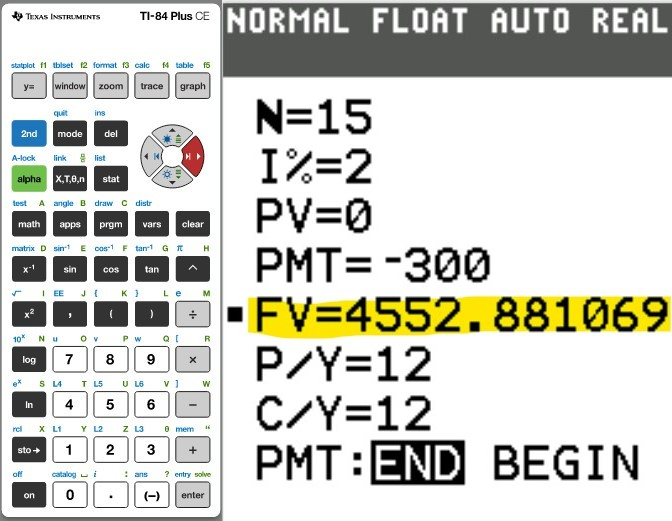

2nd Approach: Time Value of Money (TVM) Solver

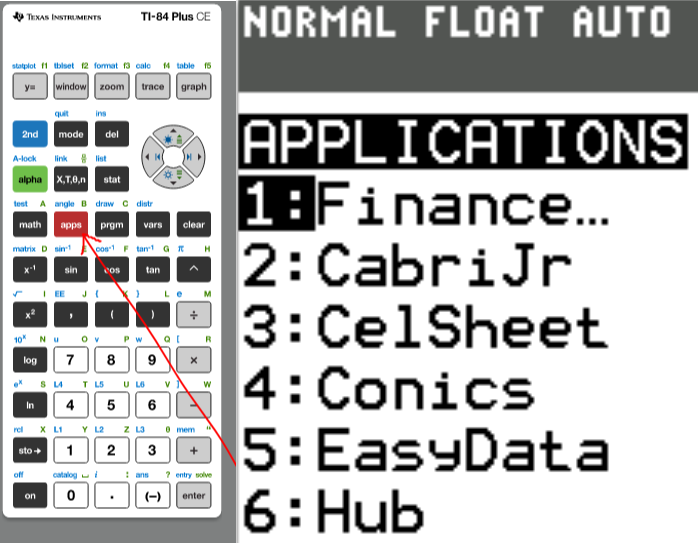

The Finance app is required.

It can be assessed by pressing the APPS button, then pressing the 1: Finance app

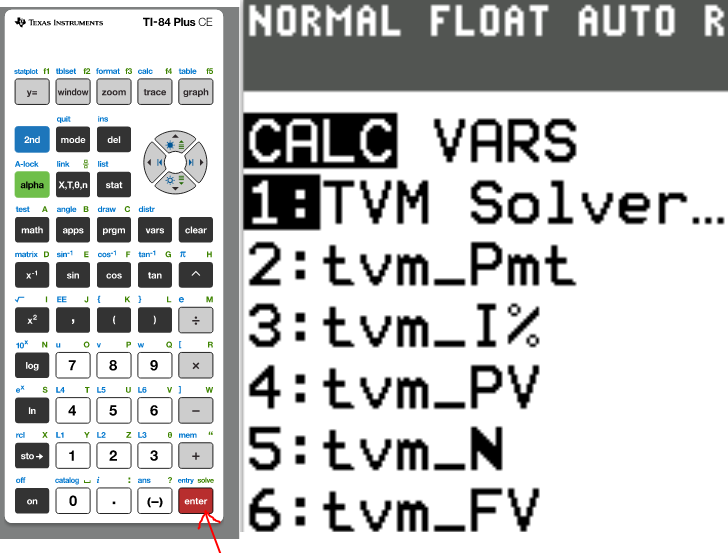

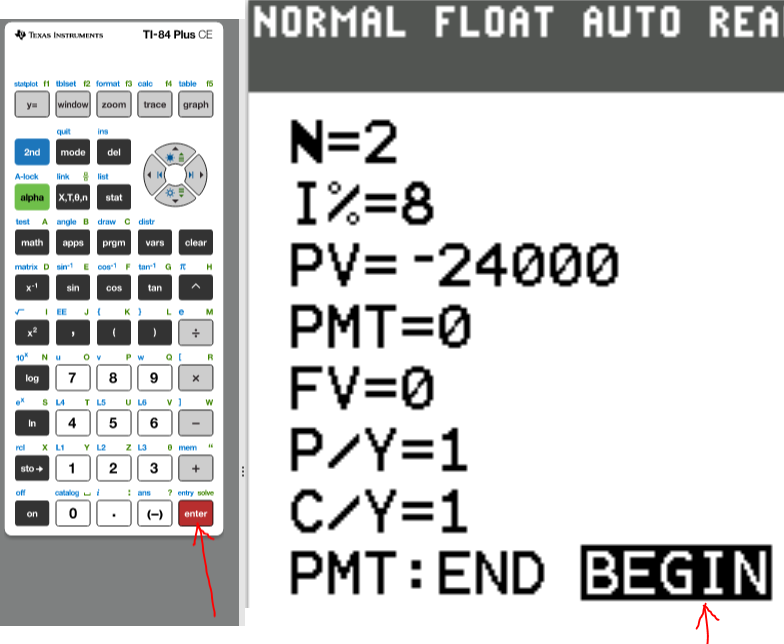

We begin with the TVM Solver (known as the Time Value of Money Solver) which is found as the first app under the CALC menu (CALC → 1: TVM Solver ...)

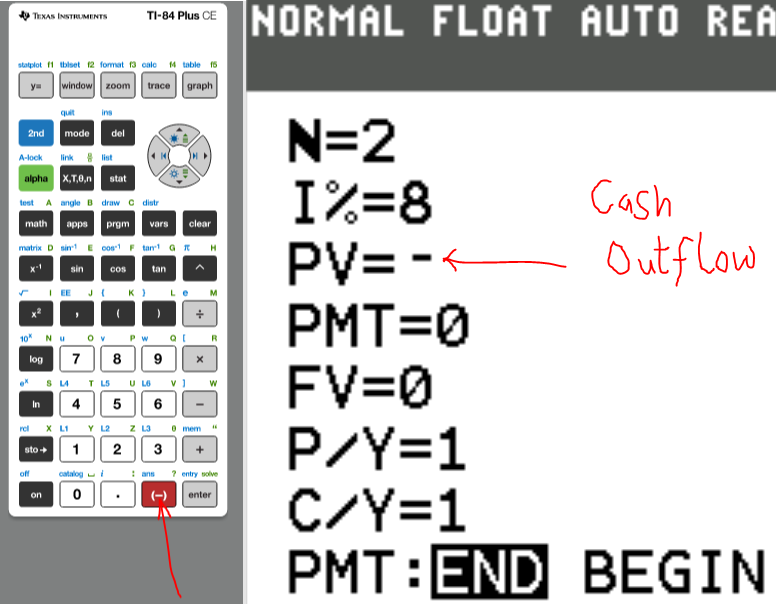

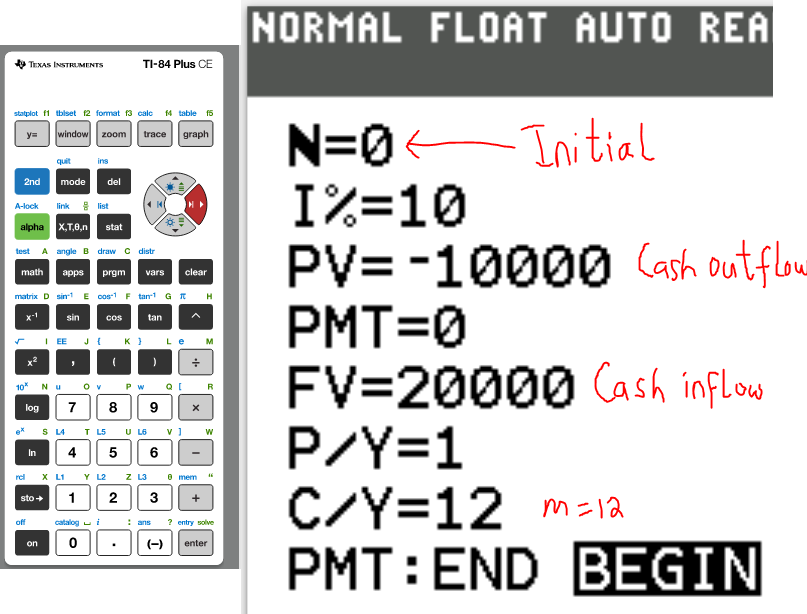

N is the total number of compounding periods (years). $N = mt$

I% is the interest rate. If it is 3%, type 3. Do not include the %.

PV is the present value.

PMT is the periodic payment.

FV is the future value.

P/Y is the number of payments per year.

C/Y is the number of compounding periods per year.

PMT:END:BEGIN Is the payment made at the end or at the beginning of the year?

Notable Notes:

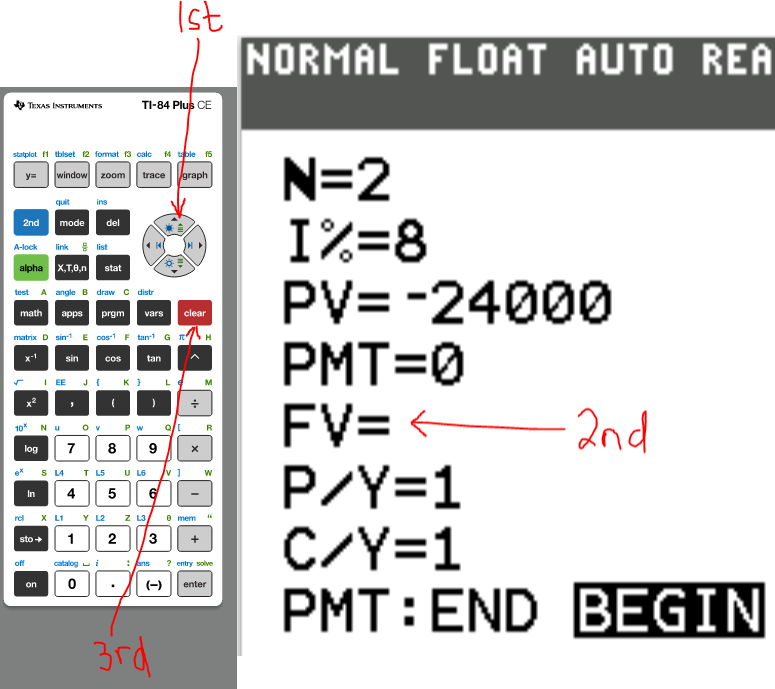

(1.) No field should be blank.

Put a value in every field.

For the value you would like to find, put 0 initially.

(2.) For any cash outflow, put a negative sign.

For any cash inflow, put a positive sign.

(3.) Indicate whether the payment is made at the END or at the BEGIN of a period.

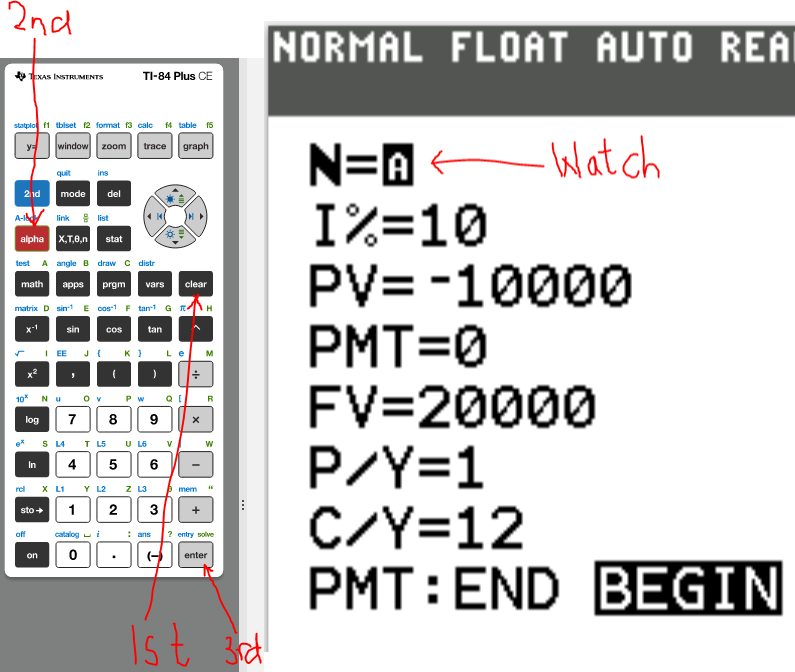

When the black focus is on any of those options, move to the field that you want to calculate.

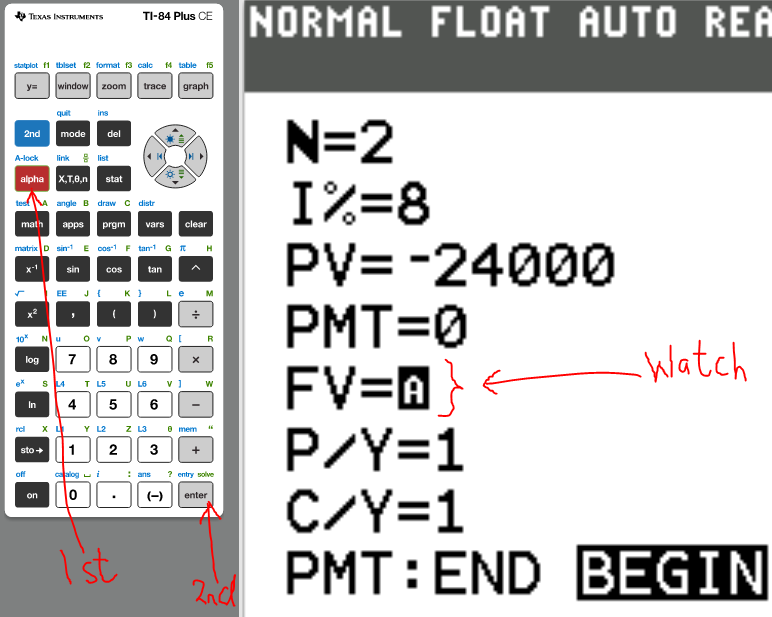

(4.) Clear the 0 that you put in initially in that field.

Press the ALPHA key

That takes us to the SOLVE menu which is above the ENTER key. So, press the ENTER key.

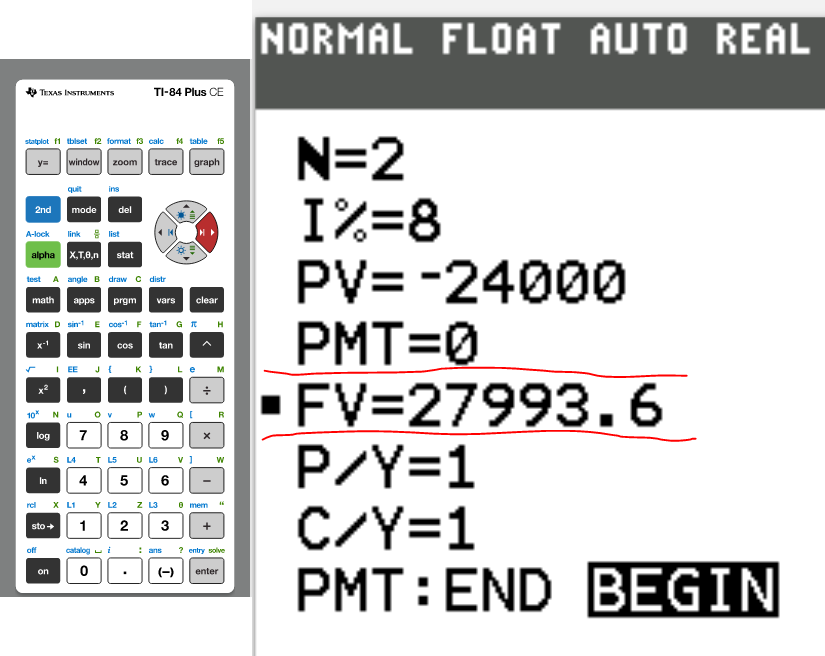

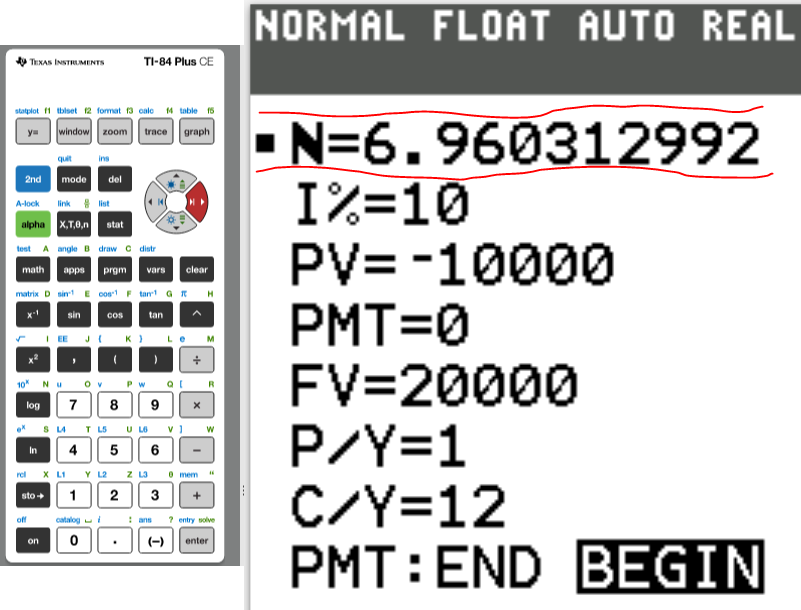

That gives the value of what you want to calculate.

Let us do some examples.

NOTE: Please begin from the first example. Do not skip.